|

House Bill 1 restores $2 million of the $18 million in funds that were swept during previous budgets from the Kentucky Heritage Land Conservation Fund (KHLCF)The effort to find funding for this program has been a perennial campaign for KCC, Kentucky Conservation Committee. See More Details in This Week's KCC Guardian Blog

Just this month, the White Oak Resilience Act (H.R. 5582) moved one step closer to becoming law. By unanimous consent, the House Committee on Natural Resources has voted to advance the bill.

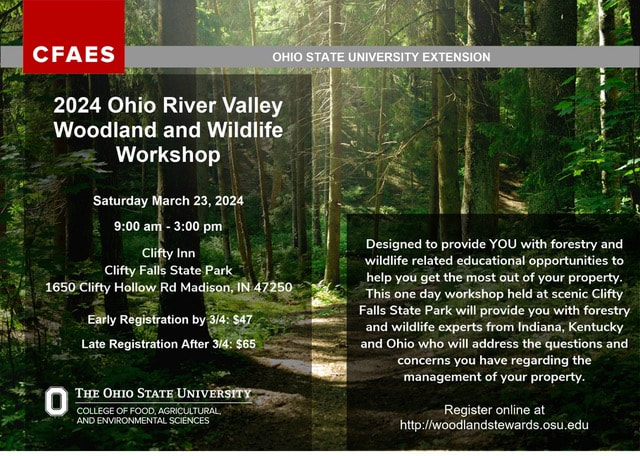

The bipartisan legislation is backed by a diverse group of cosponsors including Reps. Andy Barr (R-KY), Ami Bera (D-CA), Steve Cohen (D-TN), Scott DesJarlais (R-TN) and Morgan McGarvey (D-KY). In the words of Chairman Bruce Westerman (R-AR), the bill “will advance white oak restoration efforts through science, collaboration and philanthropic partnerships. Learn more about WORA HR 5582. Registration is open for the 2024 Ohio River Valley Woodland and Wildlife Workshop. Purdue University is this year’s host for this tri-state event so the event will be held at Clifty Falls State Park’s, Clifty Inn. Join us as natural resource experts from Purdue University Extension, University of Kentucky Extension and Ohio State University Extension will present topics that are geared towards helping you successfully manage your land. The agenda for the day is attached. Access registration here.

From Amy Metheny at WVU:  We have a new state champion! A few weeks ago, I travelled to private property to conclusively identify a suspected American chestnut. I got confirmation this morning that it is in fact the largest living American in West Virginia! This tree has beautiful timber form and bark that looks so much like a Northern red oak that I almost passed it. It also has beautiful orange, hairless twigs with orange buds unlike Chinese chestnut which has yellowish to green twigs and buds with lots of tiny hairs. The leaves on this American also have a "crashing wave" shape to the serrations and long, slender, papery, hairless leaves as opposed to the wide, pointier, more squat hairy leaves of its Chinese counterpart. As most of you know, the American chestnut was decimated by a fungal disease known as chestnut blight in the early to mid-1900s. Once growing to be 120 feet tall and up to 13 feet in diameter, according to Gifford Pinchot, finding finding tree over 25 feet now is a rarity, so you can imagine my excitement upon seeing this 80-ft monster. Luckily, this tree exhibited no signs of blight. We suspect this to be an "escape" tree, which means it likely doesn't have any blight resistance, but rather has been lucky to live far enough away from other chestnuts to have escaped infection. As a forest pathology research assistant at WVU, and someone who has worked on chestnut blight for a long time, I belong to and work closely with The American Chestnut Foundation. I'm even the reigning WV Chapter Mrs. Chestnut! TACF is aware of this tree and we will likely be collecting pollen and scion for their breeding programs this year. The landowner is incredibly generous and has kindly offered the material and his help. The Leopold Conservation Award Program recognizes and celebrates extraordinary achievement in voluntary conservation by agricultural landowners. Sand County Foundation, our national sponsor American Farmland Trust, and conservation partners across the U.S. present the prestigious honor, which consists of $10,000 and a crystal award, in settings that showcase the landowners’ achievements among their peers. The Leopold Conservation Award program widely shares the stories of these conservation-minded farmers, ranchers, and forestland owners to inspire countless other landowners to embrace opportunities to improve soil health, water resources and wildlife habitat on their working land. Finally, the program builds bridges between agriculture, government, environmental organizations, industry and academia to advance the cause of environmental improvement on private land. Watch this video to learn more about the Leopold Conservation Award. NOMINATION DEADLINE: MARCH 31, 2024

KAEE is seeking an enthusiastic and creative educator to fulfill the position of Program Director - someone with a passion for our mission and a desire to help them grow as an organization. This is a full-time, remote position serving Kentucky’s community of environmental educators. If you like to be challenged, learn a lot, have a significant impact, and work with an amazing team, you're encouraged to apply! KWOF selected Jason Ronald Brown as its 2023 scholarship award recipient. Join us at the Annual Meeting in March as we recognize Jason for his outstanding work.

Annually, the Kentucky Woodlands Owners Foundation Scholarship provides an award to an outstanding student enrolled in the University of Kentucky’s professional forestry degree program. The award is granted based on leadership potential, connection with the forestry community, and insight into the forestry profession. KWOA is asking everyone in the Woodland Community to respond to the statewide survey recently launched by the Kentucky Cooperative Extension Service and encourage expanded woodland management programming. The survey is a simple ranking of issues and toward the end there is a place to describe other issues in your community that (in your opinion) need practical education and/or assistance. This would be the place to make a request; suggested wording:

“Please expand programming to educate landowners about woodland management practices and the public about the need for this type of management across the state. The future ability of forest resources in Kentucky to provide timber/wood products and ecosystem services to protect environmental quality and provide economic benefits is dependent upon woodland management.” The survey is open to all Kentucky citizens ages 18 and up. Every voice matters. We hope you’ll take the ten-minute survey and encourage others to do the same. |

Archives

March 2024

Categories |

||||||||||||||

RSS Feed

RSS Feed